Getting My Appliance Financing To Work

Device finances are loans used to buy brand-new devices. Utilizing them can provide you some benefits over utilizing your debt card. Below are a couple of examples: - The majority of the time, an appliance financing will certainly need you to make monthly payments that can be fixed or variable, depending on the framework of the car loan.

This makes device lendings wonderful for emergency situation home appliance acquisitions. Both of these options are terrific to make use of when obtaining brand-new home appliances.

The Basic Principles Of Appliance Financing

First Look Approval is a customer money business that supplies an actual time choice engine to both block & mortar and shopping merchants, giving them the capability to supply their consumers immediate funding choices. A number of lending programs are incorporated into First Look Authorization's finance platform, giving sellers as well as borrowers alike a lot more choices when it involves customer funding.

After you've talked to a person from our team, you can expect to be signed up into the program within 5 company days. Depending on the debt deal that your consumer received and chose, settlement time will certainly vary according to the providing financial institutions' methods. For the standard program, customers are paid straight and are ACH had actually the cash within 5 company days.

While moneying times for each and every loan provider can vary, we locate that funding commonly happens within 48-72 hrs. As quickly as you are up and running, using your login as well as password, you will be able to access our back office website and also see your deals in actual time. This portal gives our sellers with state-of-the-art statistical analysis devices.

Little Known Questions About Appliance Financing.

Should you choose the light combination option (the basic integration), First Look Approval will certainly send you its marketing symbols, buttons as well as banners. Just pick the icons you like as well as include them to your site web pages. For an extra comprehensive as well as interactive option, you will certainly be called for to implement our API (the enhanced integration).

You will certainly need to include one blog post telephone call to submit the car loan request, as well as execute two postback trainers to obtain updates concerning finance requests and also consumer address information.

If among your current home appliances isn't working in addition to it when did, it's likely time to begin weighing your options pertaining to whether to fix or replace it - appliance financing. If the cost to fix the problem surpasses 50% of the device's worth, changing the device likely a smarter relocate. Mechanical and also electrical issues prevail when it involves appliances, and also lots of such troubles can be repaired for $150 to $300.

Get This Report about Appliance Financing

Perhaps the most effective time to change your home appliances is during vacation sales such as those that happen on Memorial Day, Self-reliance Day, Labor Day, Veterans Day, and also Black Friday. And an additional good time to acquire is when new designs arrive on display room floors as well as the previous year's products are discounted.

Appliance Financing Things To Know Before You Buy

Financing your appliances indicates you'll have an added costs to pay each month. Some stores might offer utilized device funding, but it relies on where you are getting your device (appliance financing). Personal financings from lenders or banks can be utilized to fund used appliances. Many loan providers and financial institutions don't ask what the individual car loan is being utilized for so you can use it to spend for used or brand-new home appliances.

Whatever option you select, ensure wikipedia reference to get a loan with low rate of interest and also reduced APR. When financing used devices, make certain the device remains in great condition and has a likelihood of lasting for many years to come. If you use a personal finance you need to not need a down repayment.

You can fund appliance repairs if you don't have adequate cash upfront to spend for the repair work. Some may prefer to make use of a reduced APR charge card to fund home appliance repair services. You might not have a reduced APR credit rating card or a restriction that is high enough to cover the repair service.

Some Known Incorrect Statements About Appliance Financing

A personal loan can be utilized to fund home appliance repair work. When you use a personal car loan the funds are transferred into your account and you can invest them like cash money. If the fixing is really pricey, some individuals pick to obtain a new home appliance as opposed to paying to fix the old one.

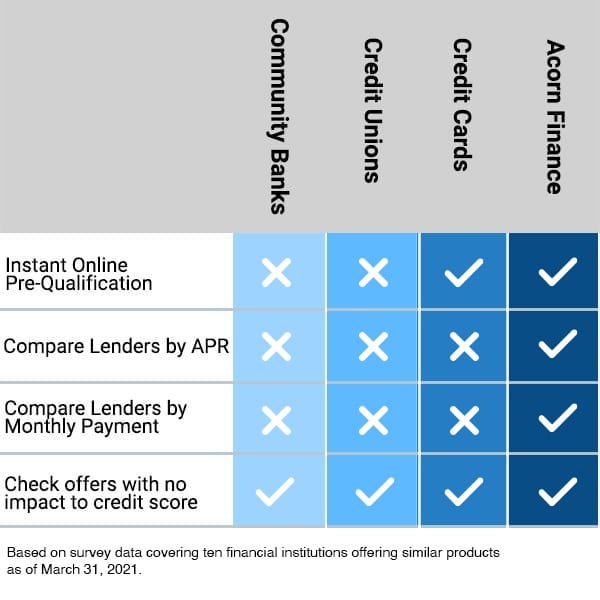

As soon as you have identified how much you require to borrow, you can continue with using for funding. Use Acorn Money to see what lenders you pre-qualify for as well as what kind of fundings you will certainly be able to obtain.

There are numerous funding alternatives for home appliance funding, as well as some are far better than others. Some home appliance shops or big stores offer in-house funding or they may companion with a Third party lender that offers the real car loan.

Appliance Financing for Beginners

In many cases, you might have the ability to locate a merchant providing a 0% promotional financing deal. If the appliance store has low-interest financing or 0% interest, this can be a good option for financing your brand-new Read More Here home appliance. appliance financing. Always ask the location you are purchasing the device from if they have in-house funding and examine the terms.

These are from financial institutions, credit history unions, or online loan providers. Depending on your credit scores score and also your debt-to-income ratio, you could certify for a low-interest individual lending.

Comments on “How Appliance Financing can Save You Time, Stress, and Money.”